Hello friends! I hope you’re doing great!

This week I wanted to write a piece about Nike, because after the last conference call I got curious about the negative performance of the stock and started investigating a bit on what went wrong to make such a great company underperform miss investors’ expectations. The inspiration for the post was this tweet:

I completely share the feeling that the Nike brand is stronger than ever, with top athletes promoting it, sneakers living the golden era and frankly a great product line (imho). I therefore wondered, similarly to this tweet, “what’s wrong here?”.

When digging deeper I expanded the scope to the overall industry and then progressively more broadly to the entire economy. I think I found some interesting insights on the current health status of the economy, which hopefully you find interesting too!

Nike’s stock performance

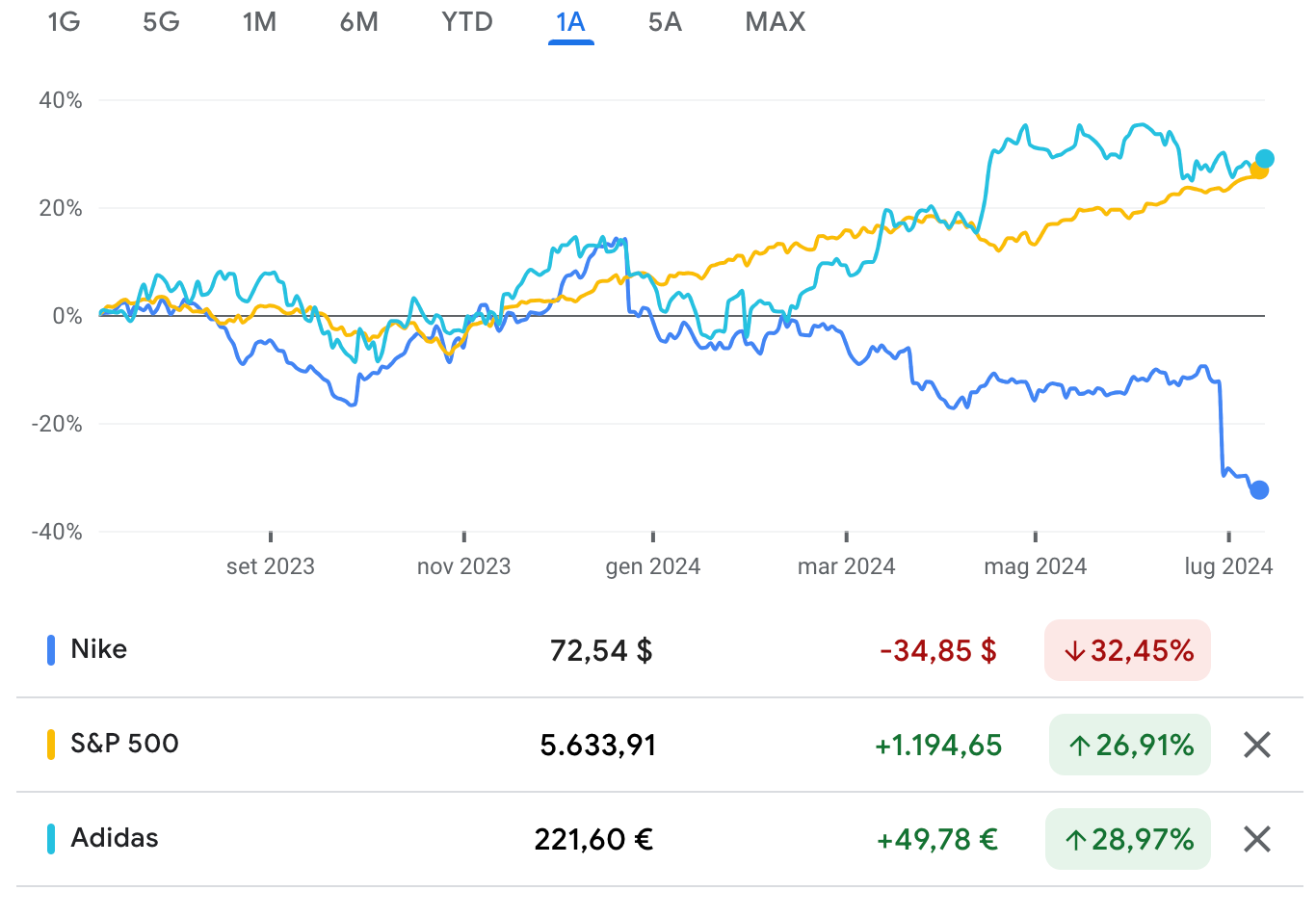

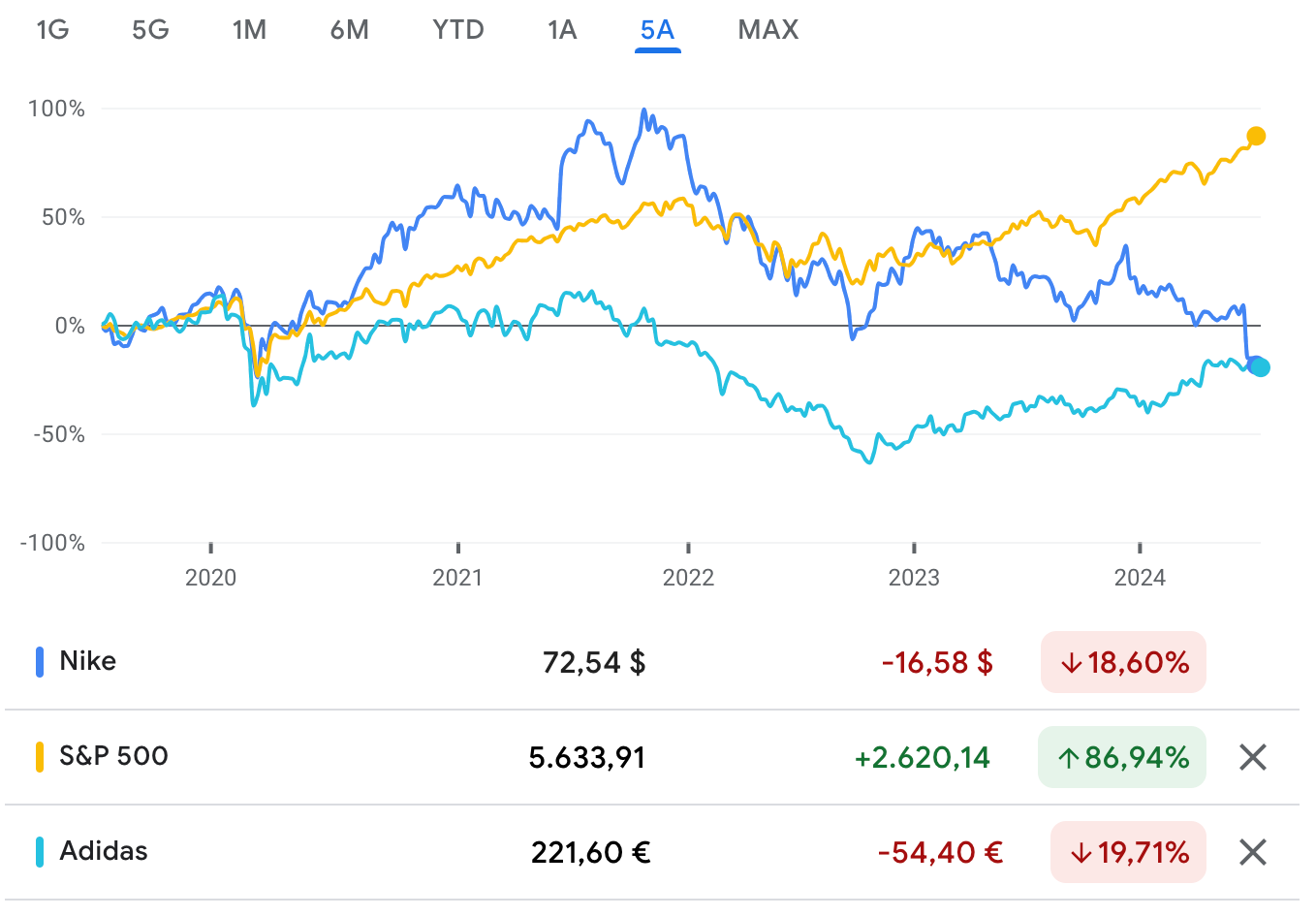

Nike’s stock has experienced a significant decline over the past year, dropping by approximately 30% . This is happening in a year where the S&P500 has instead grown by 27%, so the trend of the stock seems to be more driven by company and industry dynamics, rather than larger stock market trends.

I will expand a bit later what I found when researching, but the key factors contributing to this downturn seem to be Nike’s pivot from a direct-to-consumer (DTC) strategy back towards wholesale channels, which created strategic uncertainties. This shift came at a time when inventory issues plagued the company, leading to heavy discounting and eroded profit margins.

Another relevant factor for Nike’s underperformance has been the weakening demand in key markets like North America and China. The economic slowdown and high inflation have squeezed consumer budgets, leading to reduced spending on non-essential items, including athletic wear. This decline in demand has been exacerbated by significant inventory management issues. Nike has had to offer substantial discounts to clear excess stock, which has further impacted its profit margins and investor confidence.

As I kept researching I realized that this trend is actually not exclusive to Nike, and Adidas, Nike’s main competitor, has also faced similar challenges. Both companies have struggled with excess inventory and fluctuating demand. However Adidas seems to have found a different response from investors, since the stock trended pretty much in line with the index over the past year:

Being fair to Nike this contraction in the last year, and the comparison vs Adidas, takes a very different image when we expand the horizon. Over the past 5 years Nike had experienced a lot more growth than Adidas, as investors appreciated the DTC strategy and other strategic moves, and eventually over the past 5 years company end up in a very similar place in terms of return (both heavily underperforming the index):

Baseline effect

When I see these charts my first reaction is always to, once again, stress how well the market has done in the past 5 years. In the last year only, the S&P 500 has surged by circa 25%. If one wonders “what drove this growth then?”, the answer is very evident: S&P500 robust performance has been largely driven by the tech sector, Nvidia and the FAANG (Facebook, Apple, Amazon, Netflix and Google) stocks. These stocks’ growth was fueled by several key factors:

• Artificial Intelligence and Innovation: Companies like Nvidia have seen their stocks skyrocket due to the booming demand for AI technologies. Nvidia, in particular, has benefited from its pivotal role in supplying GPUs for AI applications, resulting in a more than 240% increase in its stock price in the last 12 months.

• Resilience of Digital Services: Meta and other tech companies have capitalized on the growing importance of digital platforms and services. Despite some setbacks in areas like the metaverse, Meta’s core business in social media and advertising has continued to thrive, contributing to its substantial stock gains.

Nike’s struggles

As I anticipated, several reasons have contributed to Nike’s underperformance over the past year. One of the most significant has been the company’s strategic pivot away from its direct-to-consumer (DTC) model back to wholesale channels. This shift introduced operational inefficiencies and increased costs at a time when the company was already grappling with other challenges.

In the aftermath of COVID-19, many companies looked into DTC strategies as a way to strengthen their brand, improve profit margins, and develop a closer relationship with consumers. The pandemic accelerated the shift towards online shopping, making DTC an attractive model for many businesses aiming to control the customer experience and collect valuable consumer data directly. Nike was among the most vocal proponents of this approach. Its CEO announced ambitious targets to derive 50% of the company’s sales from DTC channels within five years and even announced some internal reorganization to enable this growth.

Nike’s DTC strategy was initially implemented to leverage its digital capabilities, enhance customer engagement, and increase the average selling price. The company invested heavily in its digital infrastructure and direct sales channels, aiming to create a seamless and personalized shopping experience for its customers. However, things did not work out as planned (for Nike and most of DTC companies actually, as I already wrote here a year ago) and the strategic pivot back to wholesale channels created confusion and uncertainty. This move was seen as a step back from its aggressive DTC push and was interpreted by some investors as an indication of execution challenges within the company. Nike’s decision to reintegrate with key retail partners was driven by the need to address declining sales and excess inventory, but it also introduced additional operational complexities and costs .

Nike has also faced significant inventory management problems. The company had accumulated excess inventory, particularly in North America, which forced it to offer substantial discounts to clear stock. These markdowns not only impacted profit margins but also indicated potential missteps in demand forecasting and supply chain management. Notably, this overstock issue has been largely true for other players in the industry, such as Adidas, and is mainly an effect of the volatile demand dynamics during inflationary environments .

High inflation and reduced consumer spending power have exacerbated Nike’s difficulties. Consumers have become more cautious with their spending, prioritizing essential items over discretionary purchases like athletic apparel and footwear. This shift in consumer behavior has directly impacted Nike’s sales and profitability .

The “Silent Recession”

While researching for this post I came across this concept of “silent recession” which describes a scenario where traditional economic indicators might not fully capture the underlying financial strain felt by consumers.

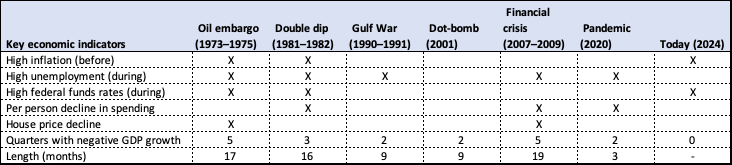

A silent recession is characterized by subtle but pervasive economic stress. While GDP growth and employment rates might appear stable, consumer behavior reflects significant financial constraints. Many consumers are prioritizing essential spending and cutting back on discretionary items. I found an interesting table that benchmarks the current situation with past recessions:

Despite most macroeconomic indicators being positive (i.e. low unemployment, no decrease in house prices, nominal GDP growth) consumer confidence remains shaky due to high inflation and rising interest rates. This has led to a shift in spending patterns, with a greater focus on essentials like groceries and utilities, and reduced expenditure on non-essential items such as apparel and electronics. Data from various studies indicate that while overall consumer spending has not drastically declined, the composition of spending has shifted significantly towards essentials .

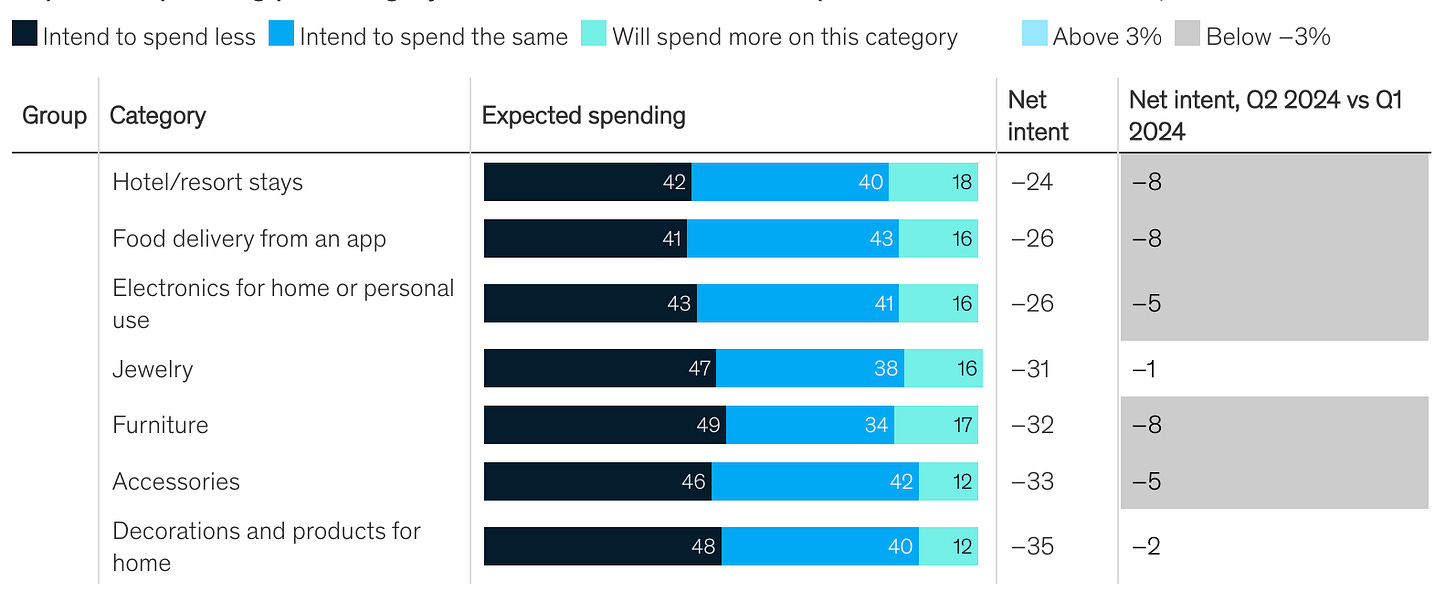

A McKinsey report highlights that consumers plan to increase their purchases of essential items while cutting back on discretionary spending. This trend is evident across various demographics, with younger and lower-income consumers particularly affected. Many consumers have also adopted “trading down” behaviors, opting for cheaper brands and retailers to manage their budgets.

Discretionary spending has seen a notable decline. Categories such as fashion, dining out, and luxury goods have been particularly affected. This has forced companies in these sectors to adapt by offering discounts, shifting marketing strategies, and exploring new revenue streams.

High inflation and rising interest rates have been central to this silent recession. The Federal Reserve’s aggressive rate hikes have increased borrowing costs, affecting consumer credit and mortgage rates. This has squeezed disposable incomes, making consumers more cautious about their spending.

Despite low unemployment rates, many households feel financially strained, leading to more conservative spending behaviors.

While official statistics may not indicate a recession, the lived experiences of many consumers reflect economic hardship. This disconnect underscores the importance of looking beyond traditional indicators to understand the full scope of economic health.

Certain sectors have shown resilience amid these challenges. The travel and home improvement sectors have benefited from a shift in consumer preferences towards experiences and home investments.

Conversely, traditional retail and apparel sectors continue to struggle. Companies in these industries have faced significant inventory management challenges, leading to heavy discounting and eroded profit margins.

Recent Developments in Inflation and Market Reactions

As I am writing this post, new economic data has just been released that further impacts the current financial landscape. On Thursday, the US inflation data were published, indicating that inflation is indeed taming. This development has significant implications for the Federal Reserve’s future policy actions, particularly the highly anticipated interest rate cuts.

The moderation in inflation has sparked a shift in investor behavior. Tech stocks, which have driven most of the upside in the past weeks, experienced a drop as investors began rebalancing their portfolios. The expectation is that lower inflation will provide relief to consumers, potentially leading to increased spending in discretionary categories .

Things move fast, and perhaps Nike will be able to recover the lost ground and we might be seeing the light out of the silent recession!

Have a great weekend,

Giovanni